But there’s a solution—Salesforce Financial Services Cloud (FSC). FSC is more than just a CRM; it’s a tool that connects data, simplifies complex processes, and allows institutions to focus on what matters: their customers. With it, financial institutions can provide personalized advice, manage interactions across all channels, and automate time-consuming tasks. It’s like giving banks the power to anticipate their customers’ needs before they ask.

What do we mean by Financial Services?

How can we define the typical organizations we’re referring to here, and how they differ?

On the one side, we have large institutions that generally speaking, are considered B2B:

- Mutual funds, Institutional Investment Managers: the big firms that come to mind when you think of “Wall Street” firms, mutual fund companies, money managers, asset managers, and the Fidelitys of the world.

- Sell-side firms/Investment banks (eg. Goldman Sach, JP Morgan).

- Custody banks

- Insurance companies

On the other side, we have a set of financial institutions that you, as an individual or small business, are used to interacting with:

- Insurance brokers

- Mortgage brokers

- Banks: community banks, retail banks.

This could be considered an oversimplification, however, I think for Salesforce and Financial Services, it’s a good way to look at it.

Key Features of Salesforce Financial Services Cloud:

FSC goes beyond a one-size-fits-all approach. It equips financial institutions with a range of features designed to boost efficiency, enhance customer engagement, and empower informed decision-making across various roles and departments. Here’s a closer look:

1. Role-Specific Functionality:

Financial Services Cloud offers role-based consoles, taking you one level up from generic interfaces. Service, insurance, wealth management, and banking consoles are some of the consoles that you can tailor as per your unique needs and workflows of different user groups, making the user experience precise and efficient.

2. Personalized Engagement:

You can capture and display personal or business milestones on client profiles using the Events and Milestones feature. This functionality allows personalized engagement by acknowledging meaningful life or business events.

3. Actionable Relationship Center (ARC):

ARC provides financial advisors, bankers, and investment bankers with a clear understanding of complex client relationships. It offers insights into household members, account history, deals, and executive information, all in one centralized location.

4. Interest-Based Targeting:

Internet-based targeting allows users to go beyond basic client information with customizable tags. Capture specific needs and interests, categorize them for easy reporting, and leverage these insights to personalize interactions and tailor services to your client’s unique preferences.

5. Effortless Document Management:

Financial Services Cloud simplifies document workflows by defining document types, creating checklists for customer files, and tracking them through an approval process. This allows customers to upload and track documents seamlessly, ensuring a smooth and efficient document submission and approval process.

The core functionality of Salesforce FSC

FSC empowers financial advisors, bankers, and customer service teams with the insights and automation needed to deliver personalized, high-quality service. Let’s explore the key features that make FSC a game-changer for financial institutions—from customer 360 views and intelligent analytics to built-in compliance management and collaboration tools.

How do Financial Services Benefit from Salesforce?

Let’s first talk about the benefits of CRM, in general. Many of these institutions are doing ‘CRM-type’ activities in their back-office record-keeping system, which of course, is designed for something else.

Say we’re a retail bank, and we have a system like Jack Henry, a long-standing system in the retail banking space. It’s a back-office system used for tracking the number of assets that they hold among other functions. However, many companies are using a back-office tool like that for CRM purposes. To phrase it another way, it’s a system that’s great for tracking transactions or loan processing, but not great for tracking interactions or marketing activities. Just having a CRM is a step forward for these organizations.

In terms of Salesforce, there are a few call-out benefits:

1. User Experience:

We in the Salesforce ecosystem sometimes take this for granted, but the tech is fantastic. When you compare it to other CRM tools that Financial Services institutions are using there, the user experience is very good, especially now with Lightning.

2. Integration

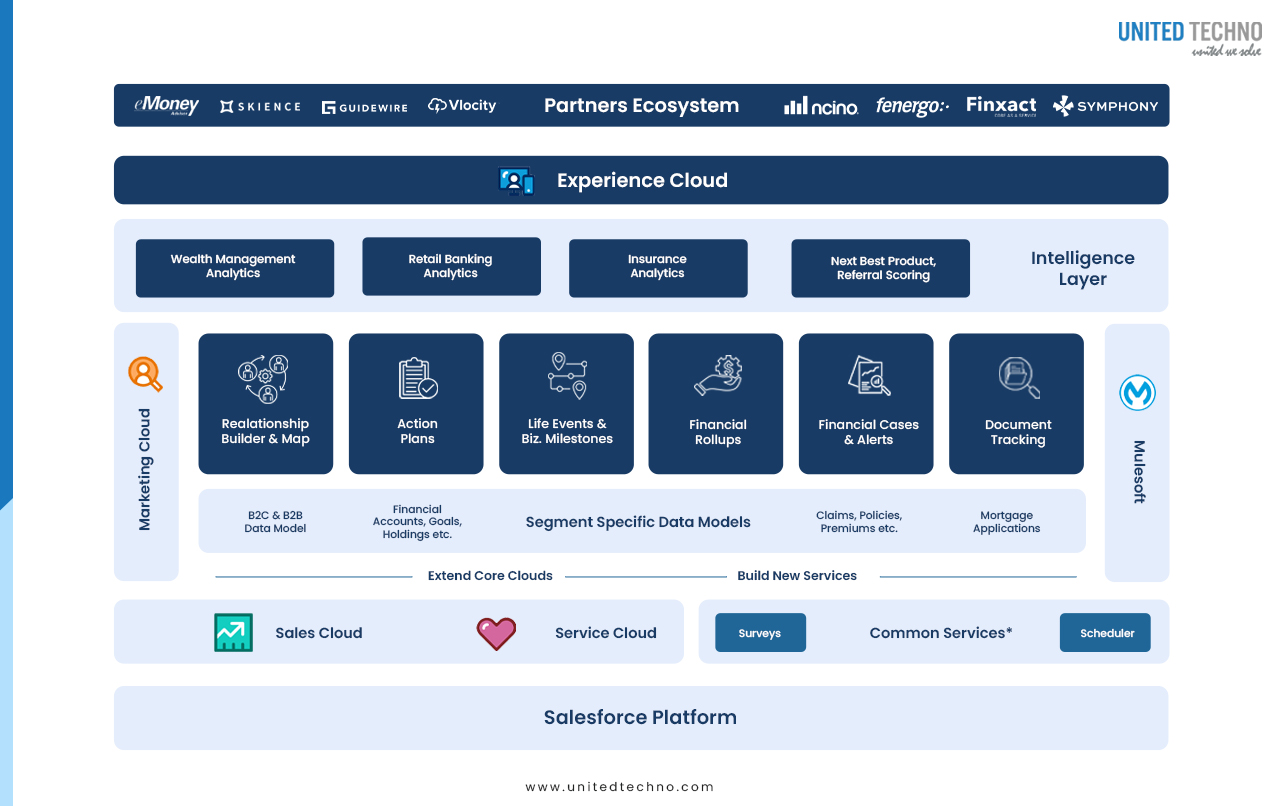

The number of integrations both within the Salesforce ecosystem and outside is very strong. What I mean by ‘inside the Salesforce ecosystem’, are the Salesforce products beyond the core Salesforce CRM, for example, marketing automation tools like Pardot or Marketing Cloud. There’s also Community Cloud (now Experience Cloud), which many of our clients use which allows you to create web portals where your customers can log in and their Salesforce data directly.

3. The Salesforce Community

The talent, knowledge sharing, and resources are available either online or in person. As you know, when you own a big CRM system knowing that you can reach out and get help either for your internal staff or hire external resources, it’s a very strong advantage that comes with being a Salesforce customer.

Conclusion

Salesforce Financial Services Cloud (FSC) transforms how financial institutions meet customer expectations while navigating industry challenges. By integrating data, automating processes, and offering personalized experiences, FSC enables organizations to build stronger relationships, improve efficiency, and stay competitive.

Whether you’re a retail bank, insurance provider, or investment firm, FSC delivers tailored solutions to simplify operations and enhance customer engagement. It’s not just about keeping pace with change; it’s about leading the way and redefining excellence in financial services. With FSC, institutions are equipped to create a future of innovation, trust, and growth. Now its your turn to transform your financial services operations with Salesforce Financial Services Cloud. Connect with our salesforce experts today to drive efficiency, growth, and client success.